tax saving tips for high income earners uk

In the event. The IRS does mandate some limitations depending upon your adjusted gross income AGI.

Advanced Tax And Business Planning For High Income Earners Wealthy Individuals Neil Jesani Cfp Youtube

Using a Discretionary Trust to reduce taxes.

. The Stocks and Shares ISA for example has an annual allowance of Â20000. Like pensions ISAs allow investments to grow free of tax. The principal amount repaid in the current financial year is included under section 80C offering a deduction up to Rs.

Or click the button below to register your interest in a free tax return quote. Stash money in your 401 k Less taxable income means less tax and 401 ks are a popular way to reduce tax bills. Certain investment and savings schemes provide legitimate ways to reduce Income Tax.

The young earners should try to take advantage of the numerous benefits that are offered under the Income Tax Act 1961 to reduce the total taxable money. Start a conversation on our Live Chat if you have questions on this or other tax return topics. There is a five-year carry-forward for unused deductions.

She also has a partner who earns a salary of 180000 pa. You will incur no capital gains tax on gifts of appreciated. Both are studying and will continue education for another 5 years.

Also offering high returns ELSS funds assistance in saving tax. Some of the great tax savings tips for the young earners. The contribution you will make.

Saving and investing within an ISA is another tax-efficient strategy for high earners to consider. Max Out Your Retirement Account. Get FREE access to my E-BOOK 3 TRAINING VIDEOS with vital tax saving tips.

Whilst the bond issuers are not liable for UK Income Tax or Capital Gains Tax a UK-domiciled bond holder will have gains taxed as income so 40 45 for high earners in 202021 if. The IRS doesnt tax what you divert directly from your paycheck into a 401. Hopefully these tax-saving tips for high-income earners will help them realize the power of a home-based business.

Jane earns 230000 salary per year and has 2 adult children of 19 and 18. What this suggests is that for example if your business makes 100000 20 of that is 20000 with the goal thats a finding. Yes British high earners really do pay significantly less income tax than their European counterparts with the 80000 earner taking home as much as 8000 more than their Dutch equivalent.

Here are five tax saving tips that are easy to apply. If your 401k plan allows after-tax contributions then as a high income earner you have a tremendous opportunity. This anyway is a finding rather than an assessment credit.

The annual allowances for ISAs are quite generous today. Ad Build an Effective Tax and Finance Function with a Range of Transformative Services. Here are 50 tax strategies that can be employed to reduce taxes for high income earners.

Tax Advisory Services with Dedicated Tax Consultants and a Flexible Suite of Services. Its extremely difficult to get ahead in. This increased tax burden for high earners is a deliberate policy by the Government which stated.

There are five ways to get an income tax deduction on your home loan s. 50 Best Ways to Reduce Taxes for High Income Earners. If you are an employee and you have an employer-sponsored 401k or 403b in 2018 you can contribute up to 18500 per year of your gross income.

Deduction for cash up to 60 of AGI. Investing in the Equity Linked Saving Scheme ELSS. Deduction for securities and other appreciated assets up to 30 of AGI.

Get Deductions us. Register your interest today for a tax return quote. Hopefully these tax-saving tips for high-income earners will help them realize the power of a home-based business.

You can avoid at least some of this tax by gifting your intended heirs while you are still alive. The tax rate for any value that exceeds the exclusion ranges from 18 percent to 35 percent. As a clear result.

Use your home loan efficiently to save more tax. 80C 24 80EE 80EEA. Utilizing the segment 199A derivation you get the chance to deduct up to 20 of the benefits of your independent company or your rental land.

As tax allowances are progressively withdrawn on any income over 100000 there is also a marginal effective rate of c60 that applies to any income between 100000 and 125000 regardless of where you reside in the UK. We look at various ways those on high incomes can invest tax-efficiently.

How To Save On Income Taxes Using An Ingenius Trust

How To Do Backdoor Roth Ira Roth Ira Roth Ira Contributions Finance

7 Roth Ira Advantages In Saving For Retirement Inside Your Ira Many Americans See A Roth Ira As A G Roth Ira Saving For Retirement Investing For Retirement

Pin On Best Of The Millennial Budget

Tax Minimisation Strategies For High Income Earners

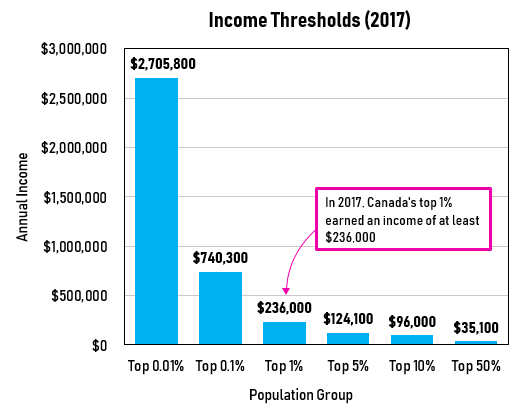

Tax Tips For Low Income Earners In 2022 Loans Canada

How To Pay Less Taxes For High Income Earners Wealth Safe

Tax Planning Strategies For High Income Earners The Private Office

Retirement Options For High Income Earners Canaccord Genuity

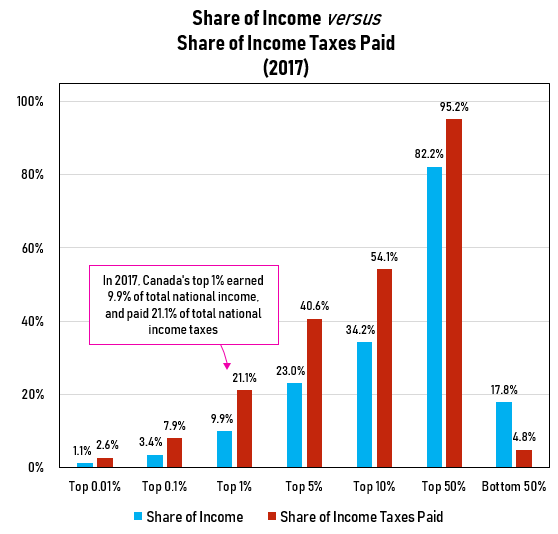

How Can I Reduce My Taxes In Canada

High Income Earners Fail To Appreciate The Math Of 529 Plans Part Ii Resource Planning Group 529 Plan Saving For College Retirement Savings Plan

This Startup Wants To Help Young High Earners Retire Early By Saving On Taxes

How To Save Taxes For Self Employed In Canada

Not All Vehicles Are Created Equal And For High Earners In Particular The Conventional Wisdom May Not Apply Savings Strategy Financial Planning Hierarchy

Income Tax Rates For The Self Employed 2020 2021 Turbotax Canada Tips